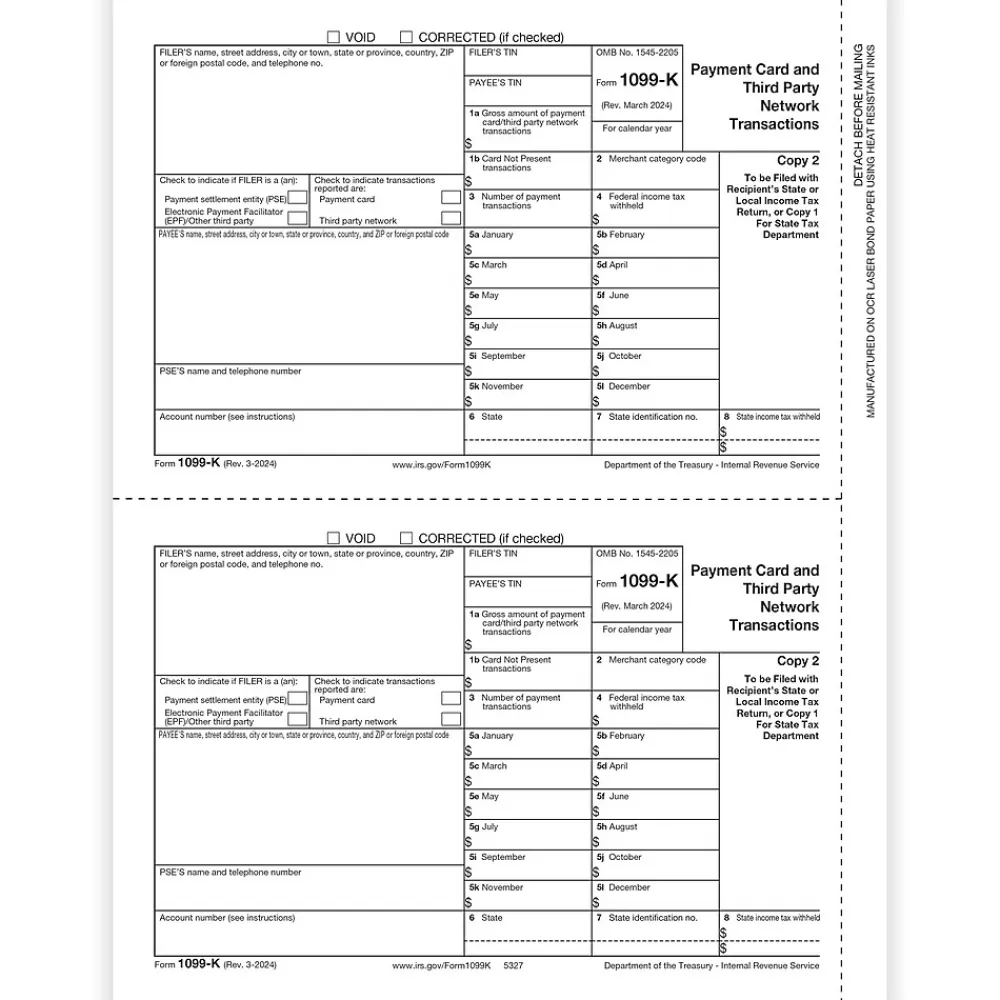

ComplyRight 2024 1099 Tax Form, 2-Part, 2-Up, Copy C, 100/Pack (5327) Cheap

$39.00 $24.18

A payment settlement entity (PSE) must file the ComplyRight Form 1099-K for payments made in settlement of reportable pa…

A payment settlement entity (PSE) must file the ComplyRight Form 1099-K for payments made in settlement of reportable payment transactions for each calendar year. A PSE makes a payment in settlement of a reportable payment transaction, that is, any payment card or third-party network transaction, if the PSE submits the instruction to transfer funds to the account of the participating payee to settle the reportable payment transaction. A PSE is a domestic or foreign entity that is a merchant acquiring entity, such as a bank or other organization that has the contractual obligation to make payment to participating payees in settlement of payment card transactions; or a third party settlement organization (TPSO) that has the contractual obligation to make payments to participating payees of third-party network transactions.

- Use the filer Form 1099-K for payments made in settlement of reportable payment transactions for each calendar year

- Features a two-part format

- 2-up format: one sheet equals two forms

- Includes copy C

- 100 tax forms per pack

- Dimensions: 8.5″ x 11″

- Laser printer compatible

| Attribute name | Attribute value |

|---|---|

| Acid Free | 11 |

| Number of Parts | 51+ |

| Print Type

The different types of selling UOM: Pack, Case, Carton, etc

|

Pack |

| Tax Form Pack Size | 1099 |

| True Color

The overall width of the product, measured left to right.

|

8.5 |

| Year

The tax year the form is applicable to.

|

2024 |

Be the first to review “ComplyRight 2024 1099 Tax Form, 2-Part, 2-Up, Copy C, 100/Pack (5327) Cheap” Cancel reply

Related products

Copy & Printer Paper

Copy & Printer Paper

Staples 8.5″ x 11″ Multipurpose Paper, 22 lbs., 98 Brightness, 2500/Carton (16345-US) Cheap

Copy & Printer Paper

Construction Paper

Southwest School Supply 12″ x 18″ Construction Paper, Slate, 50 Sheets/Pack (P103060) Fashion

Copy & Printer Paper

Neenah Paper Neenah Astrobrights Paper, 11″ x 17″, 60lb., Text, Pulsar Pink, 2500/Carton (21033) New

Copy & Printer Paper

Hammermill 8.5″ x 11″ Multipurpose Paper, 65 lbs., Blue, 250 Sheets/Ream, 2 Reams/Pack (400520) New

Construction Paper

Tru-Ray 9″ x 12″ Construction Paper, Salmon, 50 Sheets (P103010) Fashion

Reviews

There are no reviews yet.