ComplyRight 2024 1099-MISC Tax Form, 1-Part, 4-Up, Copy B, 2, 500/Pack (5501) New

$122.00 $87.00

File the ComplyRight Form 1099-MISC for each person in the course of your business to whom you have paid the following d…

File the ComplyRight Form 1099-MISC for each person in the course of your business to whom you have paid the following during the year: at least 10 dollars in royalties or broker payments in lieu of dividends or tax-exempt interest; at least 600 dollars in rents, prizes, and awards; any fishing boat proceeds; medical and health care payments; and various other income payments including, but not limited to, those to an attorney or nonqualified deferred compensation. You must also file the Form 1099-MISC for each person from whom you have withheld any federal income tax under the backup withholding rules regardless of the amount of the payment.

- File the Form 1099-MISC according to the printed backer IRS instructions

- Tax form page format: 4-Up

- Includes copies B/2

- 500 tax forms per pack

- Z-fold blank tax form with pressure seal

| Attribute name | Attribute value |

|---|---|

| Acid Free | 11 |

| Number of Parts | 51+ |

| Print Type

The different types of selling UOM: Pack, Case, Carton, etc

|

Pack |

| Tax Form Pack Size | 1099-MISC |

| True Color

The overall width of the product, measured left to right.

|

8.5 |

| Year

The tax year the form is applicable to.

|

2024 |

Be the first to review “ComplyRight 2024 1099-MISC Tax Form, 1-Part, 4-Up, Copy B, 2, 500/Pack (5501) New” Cancel reply

Related products

Copy & Printer Paper

Staples 8.5″ x 11″ Multipurpose Paper, 22 lbs., 98 Brightness, 2500/Carton (16345-US) Cheap

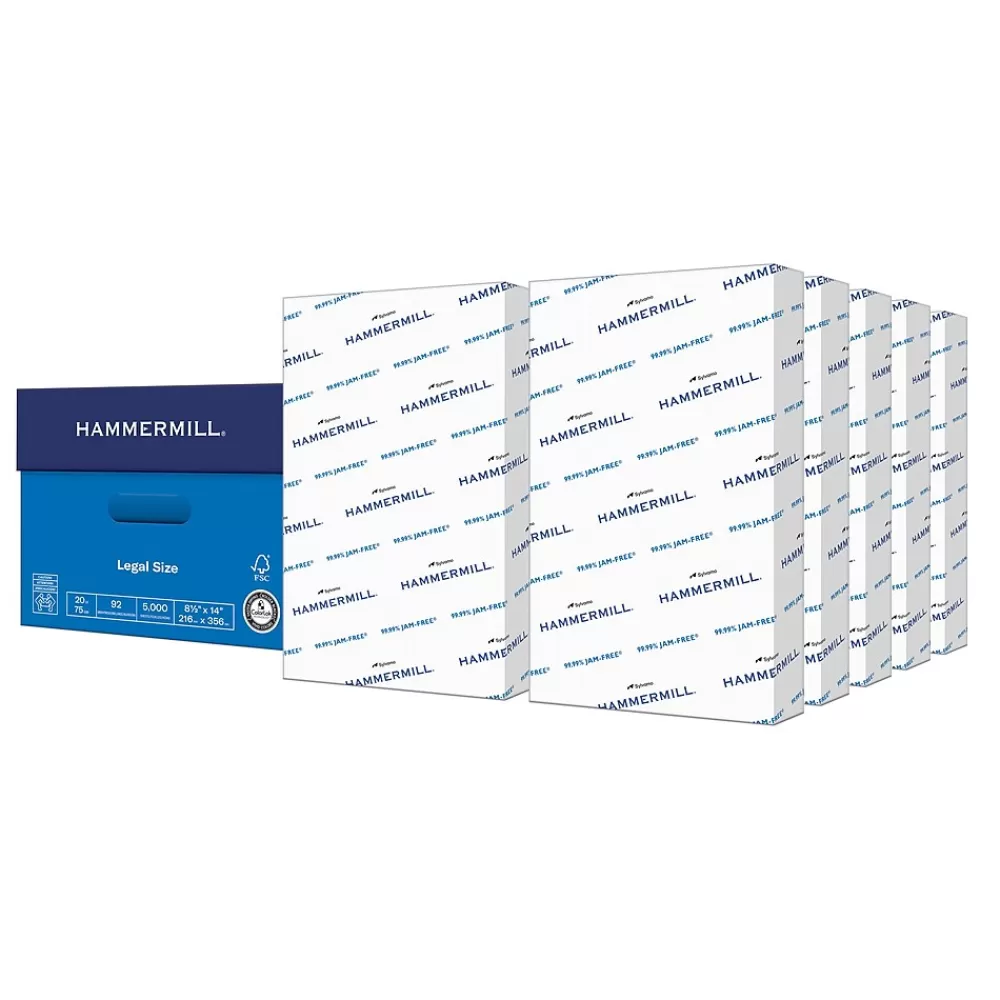

Copy & Printer Paper

Hammermill Copy Plus 8.5″ x 14″ Copy Paper, 20 lbs., 92 Brightness, 5000 Sheets/Carton (105015) Shop

Classroom Paper

Barker Creek Kai Ola Sea Turtles Computer Paper Pack, 100 Sheets/Set (4204) Clearance

Copy & Printer Paper

Southworth Linen Resume 8.5″ x 11″ Multipurpose Paper, 32 Lbs., 100 Brightness (RD18ACFLN) Shop

Reviews

There are no reviews yet.