ComplyRight 2024 1095-B Tax Form, 1-Part, White/Black, 25/Pack (1095BIRSC25) Best

$24.00 $20.40

The ComplyRight 1095-B form is used to report certain information to the IRS and to taxpayers about individuals who are …

The ComplyRight 1095-B form is used to report certain information to the IRS and to taxpayers about individuals who are covered by minimum essential coverage. Every person that provides minimum essential coverage to an individual during a calendar year must file an information return reporting the coverage. Small employers that aren’t subject to the employer shared responsibility provisions sponsoring self-insured group health plans will use forms 1094-B and 1095-B to report information about covered individuals.

- 1095-B tax continuation form used to report certain information to the IRS and to taxpayers about individuals who are covered by minimum essential coverage

- Single-part

- For laser printers

- Pack of 25

- Dimensions: 11″ x 8.5″

| Attribute name | Attribute value |

|---|---|

| Length in Inches

The different types of selling UOM: Pack, Case, Carton, etc

|

Pack |

| Number of Parts

Actual manufacturer name for the color of the product.

|

White/Black |

| Tax Form Pack Size | 1-25 |

| Acid Free

The tax year the form is applicable to.

|

2024 |

| Width in Inches | 1095-B |

| Print Type | Continuous |

Be the first to review “ComplyRight 2024 1095-B Tax Form, 1-Part, White/Black, 25/Pack (1095BIRSC25) Best” Cancel reply

Related products

Copy & Printer Paper

Copy & Printer Paper

Copy & Printer Paper

JAM Paper 12″ x 18″ Multipurpose Paper, Midnight Black, 50/Pack (1218-P-B-50) Store

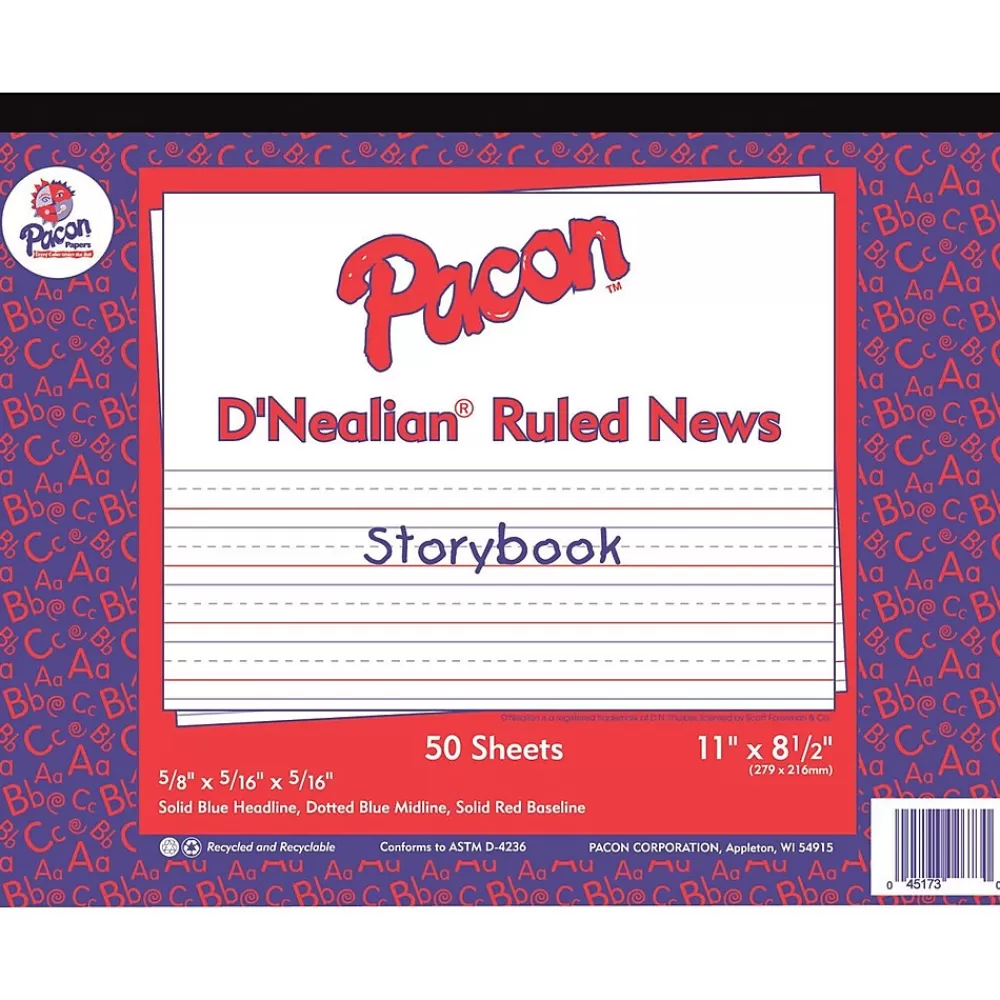

Classroom Paper

Barker Creek Kai Ola Sea Turtles Computer Paper Pack, 100 Sheets/Set (4204) Clearance

Copy & Printer Paper

Reviews

There are no reviews yet.