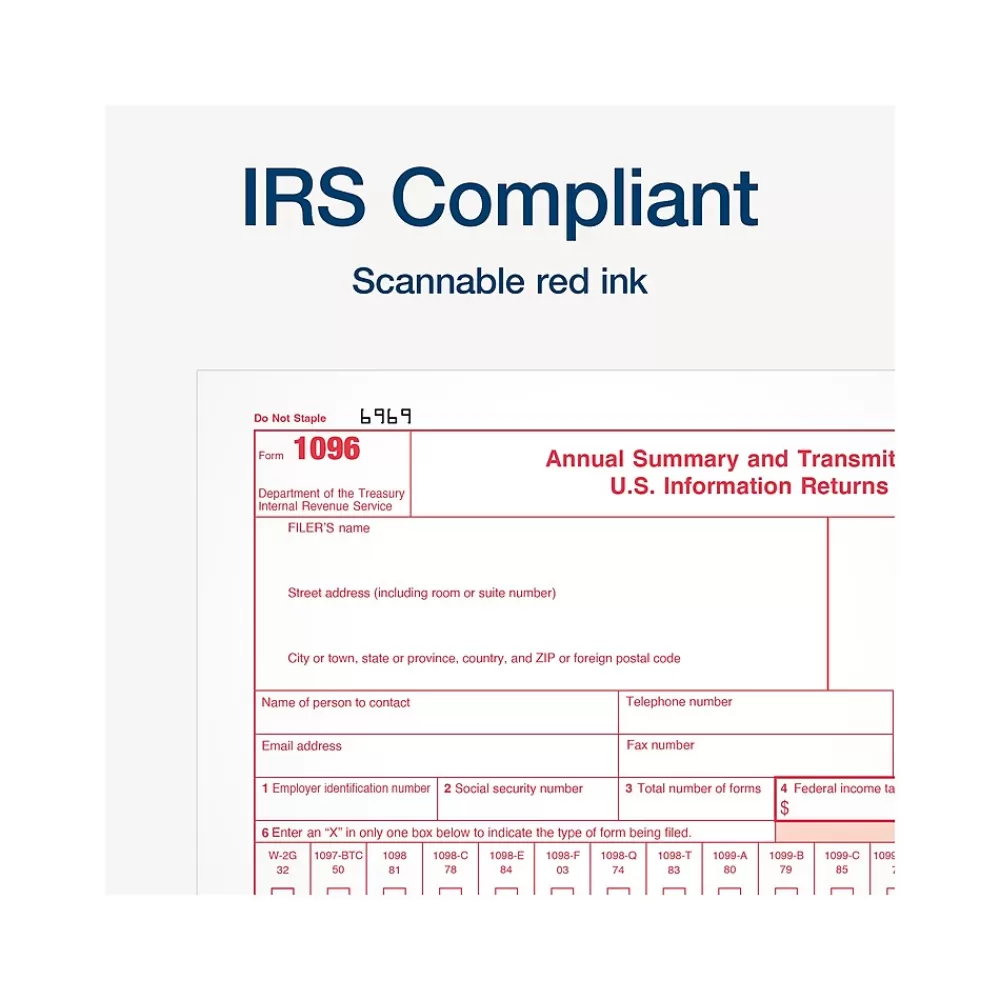

Adams 2024 1096 Summary Tax Form, 10/Pack (STAX1096-24) Clearance

$10.00 $8.10

Don’t forget—you’ll need a 1096 summary report for each type of 1099 form you file. Our Adams Tax 1096 10-pack alw…

Don’t forget—you’ll need a 1096 summary report for each type of 1099 form you file. Our Adams Tax 1096 10-pack always comes in handy on tax day.

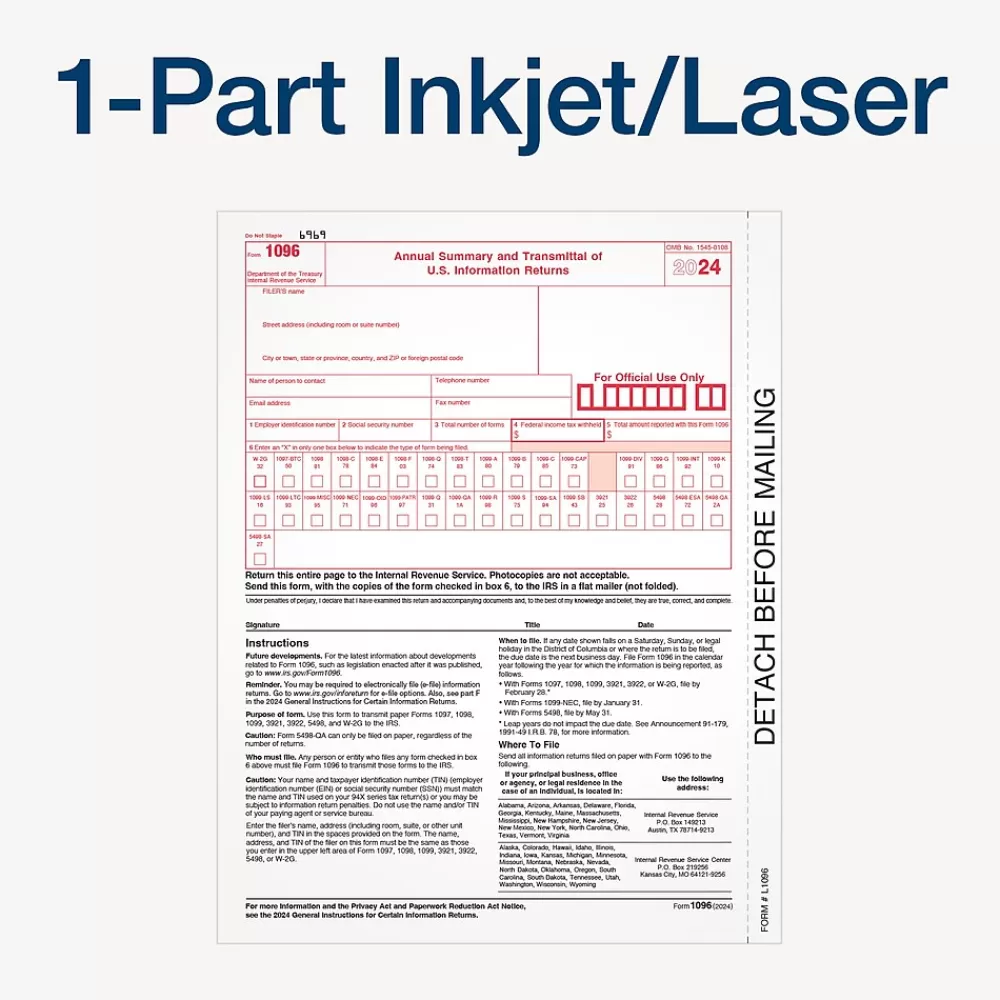

- Use Form 1096 to submit the totals from information returns 1097, 1098, 1099, 3921, 3922, 5498, and W-2G to the IRS

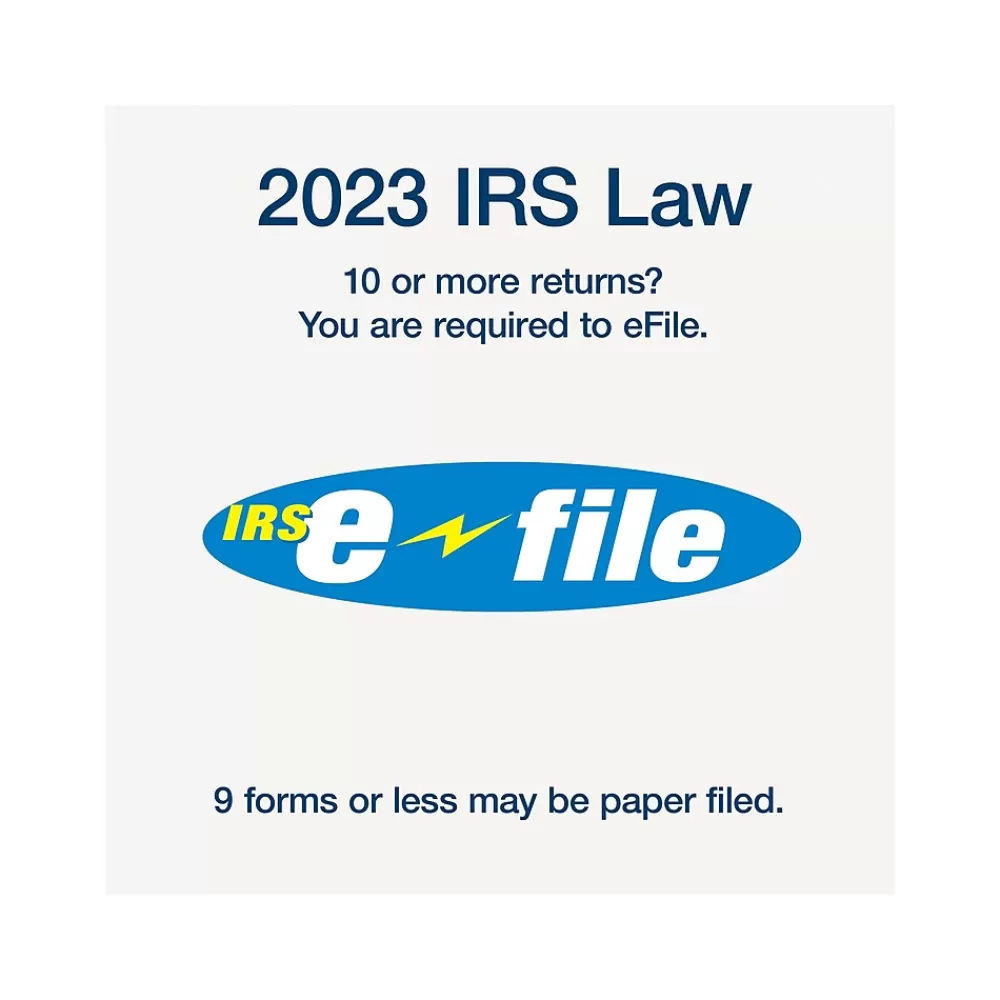

- A 1096 summary transmittal form must accompany each type of 1099 mailed to the IRS—due dates will vary by form; as of 2023, IRS eFile regulations require e-Filing for 10 or more returns of certain forms; Try Adams Tax Forms Helper to eFile to the IRS/SSA!

- Single-part forms; meets IRS specifications

- All Adams laser tax forms are inkjet and laser printer compatible

- Pack contains ten 1096 summary forms

- Sheet Size: 8-1/2″ x 11″ Detached Size: 8″ x 11″

- White forms have scannable red ink required by the IRS for paper filing

- Acid-free paper and heat-resistant inks produce smudge-free, archival-safe records

- You can always upgrade to Adams Tax Forms Helper; compatible with QuickBooks and other accounting and tax software programs

- Online access to Adams Tax Forms Helper sold separately

- 2024 IRS Change: COPY-C has been removed from the 1099-MISC; Adams Tax Forms Helper lets you save digital copies

- Online access to Adams Tax Forms Helper sold separately

| Attribute name | Attribute value |

|---|---|

| Selling Quantity (UOM)

Refers to the items included in a kit.

|

Pack contains ten 1096 summary forms |

| Number of Parts | 10 |

| Number of Recipient or Employees

Acid content determines how long the paper or product will last before breaking down. The acid level is measured by the pH (potential of hydrogen) on a scale from 0 to 14. Acid Free (alkaline) paper has a higher pH (above 7), has a longer life expectancy, and is less likely to discolor and break down over time.

|

Acid Free |

| Year

The overall width of the product, measured left to right.

|

8.5 |

| True Color | 11.25 |

| Print Type | 1096 |

Be the first to review “Adams 2024 1096 Summary Tax Form, 10/Pack (STAX1096-24) Clearance” Cancel reply

Related products

Sale!

Copy & Printer Paper

Sale!

Sale!

Copy & Printer Paper

Pacon Kaleidoscope Multipurpose Paper, 24 lbs., 8.5″ x 11″, Hot Pink, 500/Ream (102052) Discount

Sale!

Construction Paper

Tru-Ray 9″ x 12″ Construction Paper, Salmon, 50 Sheets (P103010) Fashion

Sale!

Sale!

Copy & Printer Paper

Sale!

Copy & Printer Paper

Sale!

Construction Paper

Pacon Tru-Ray 12″ x 18″ Construction Paper, Gold, 50 Sheets/Pack, 3/Pack (PAC102998) Cheap

Reviews

There are no reviews yet.